‘£7 billion electoral gamble’ to abolish inheritance tax unlikely to pay off, according to new research

2023 has seen frequent briefings to the media that inheritance tax is to be cut or abolished altogether. In the end, abolishing inheritance tax was not a feature of the Chancellor’s Autumn Statement. But with The Telegraph running a major campaign against the tax and momentum building on the centre-right of politics, it’s an idea unlikely to go away anytime soon.

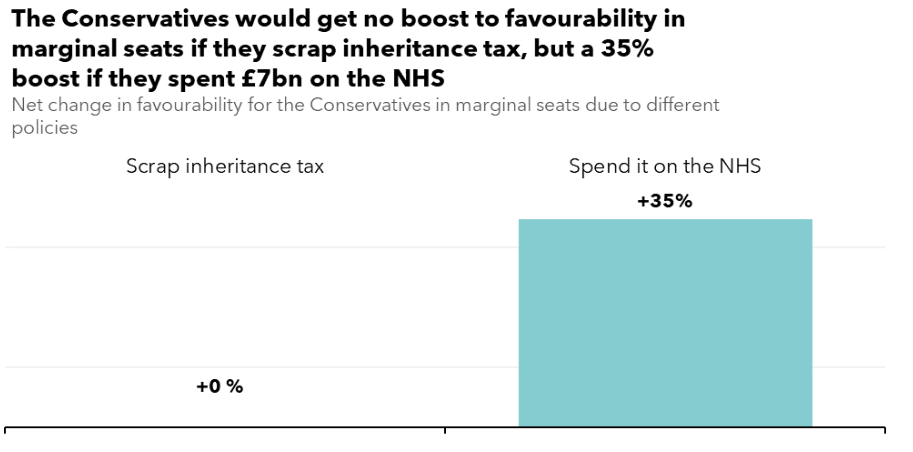

However, Demos research published today finds that abolishing inheritance tax is unlikely to revive the Conservatives’ fortunes and instead looks like a £7 billion electoral gamble. New polling commissioned by Demos found that abolishing the tax would drive no change in favorability for the Conservatives in marginal seats, whereas spending the £7 billion raised by inheritance tax on the NHS would drive a net increase of 35 percentage points in favourability for the Conservatives in marginal seats.

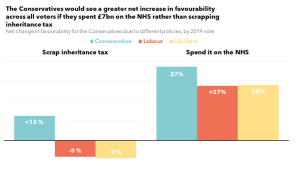

The think tank estimates that spending the money on the NHS rather than cutting inheritance tax would drive a 32 percentage point net increase in favourability for the Conservatives. Using the money for public services would attract support across the political spectrum with Conservative, Labour and Liberal Democrat voters all more likely to say that they would view the Conservatives more favourably.

The polling found that while 18% of the public say abolishing IHT would boost their favourability towards the Conservatives, these gains would be cancelled out by a similar proportion (17%) saying it would make them feel less favourable towards the party.

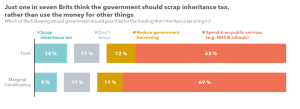

The findings are based on a poll of over 2,000 GB adults. The poll also found that when the public is asked how best to spend the £7 billion raised by inheritance tax (IHT), three quarters of the public (76%) would opt to keep the £7 billion raised through inheritance tax (IHT) and use it to increase funding on public services such as the NHS or reduce borrowing. Only 14% want to abolish it altogether.

The polling also found that more people believe that abolishing inheritance tax is irresponsible than responsible, given the current economic climate. Two-fifths of the public (40%) believe that move would be irresponsible, compared to just 30% who believe it would be responsible.

Andrew O’Brien, Director of Policy and Impact at Demos said:

“It is important that politicians engage with the public and understand their views when making big policy decisions. Our research has found that public attitudes on inheritance are complex. Whilst inheritance tax is unpopular, people see some form of taxing inheritance as necessary.

“This new polling shows that the Conservatives are unlikely to turn their electoral prospects around if they propose to cut or abolish inheritance tax given the state of public services and our economic situation.

“Abolishing inheritance tax would be a £7bn electoral gamble which, based on our research, is unlikely to pay off. Instead of thinking about this in electoral terms, policy makers should commit to reviewing the taxation of inheritances and wealth in the UK and work with the public to build a better system.”

-ENDS-

NOTES TO EDITORS

Methodology

The research by Demos is based on a 2,014-person nationally representative survey of GB adults running from Thursday 28 September to Monday 2 October 2023. The survey was conducted using the support of Opinium, a polling company. All views contained within the report are those of Demos.

Marginal seats are defined as the 150 Conservative-held constituencies with the smallest majorities.

About the Unlocking Inheritance programme at Demos

As the value of inheritances in the UK has doubled in recent decades and continues to increase, Demos is undertaking a new programme of work – supported by the abrdn Financial Fairness Trust – to explore what the UK’s ‘new age of inheritance’ means for the country. To do this, we will be publishing a series of briefing papers on the topic, conducting new research on public attitudes towards inheritance and convening a series of events.